Tiger has invested heavily into Europe's emerging tech firms, effectively indexing private startups over the last two years. The firm took a hit to its private portfolio this quarter and cut valuations every month this year, according to Bloomberg, citing an investor letter. Last year, the firm backed more than 300 startups, a frantic pace of investment that took place during a period of over-exuberance and soaring tech company valuations. It has backed many successful tech companies, including Spotify and Roblox.

Tiger Global manages approximately $65 billion, split between a public hedge fund, a long-only public fund, and private venture capital funds. Insider has reached out to Curtius for comment. Rumors of Curtius' exit have circulated for months. He is departing the New York investor to establish his own fund called Cedar Investment Management, according to reports from the FT and The Information.

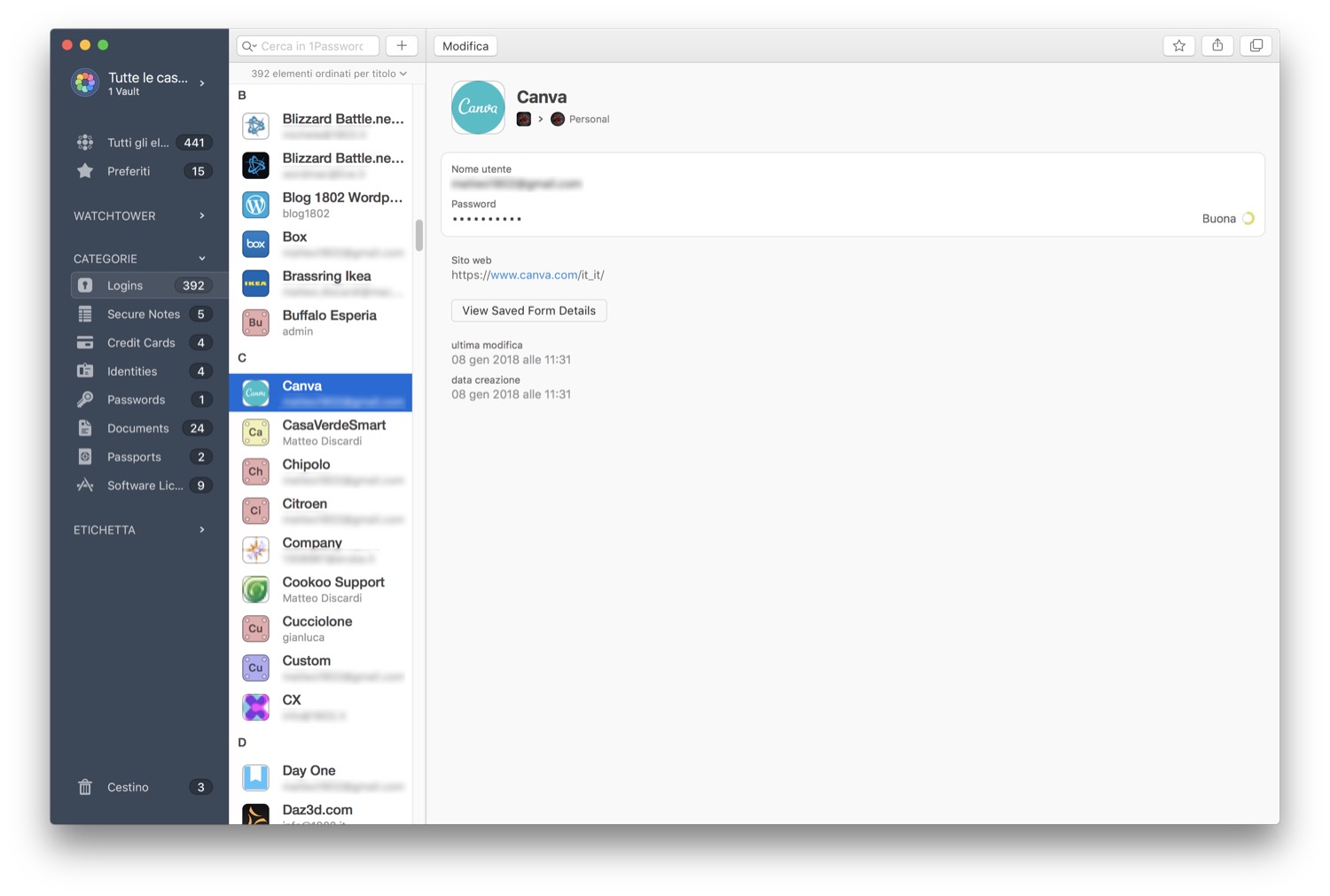

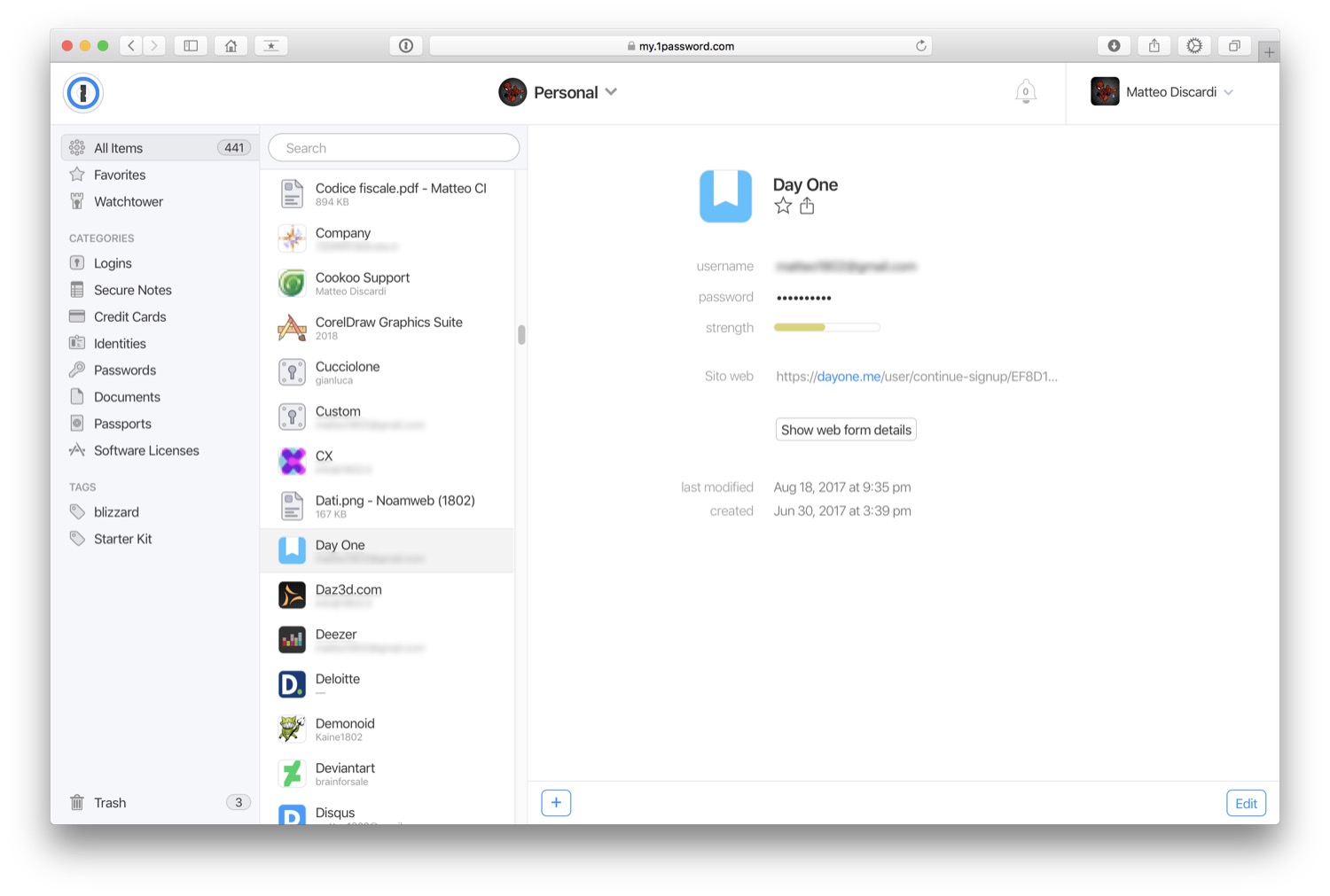

#1password 7 software#

He oversaw the bulk of the firm's private software and business-to-business investments, often at heightened valuations, including 1Password, Dataiku, and Hopin, as well as some public deals. One of Tiger Global's most prolific startup dealmakers, John Curtius, is leaving the investment firm amid a downturn in private tech valuations.Ĭurtius has been at Tiger for almost six years, coming to the firm from activist investors Elliott. Curtius will establish his own fund called Cedar Investment Management, per media reports.The investment firm was been hit hard by the sharp selloff in public tech stocks this year.Tiger Global partner John Curtius is set to leave the fund next year.

0 kommentar(er)

0 kommentar(er)